With the Federal Reserve (Fed) increasing interest rates on the target Federal Funds rate since early 2022, the available market yields on cash, money markets, certificates of deposit, and other short-term cash equivalent investment products have increased to as much as 5% (from essentially 0% over the 2020-2021 COVID-19 environment). The 90-day U.S. Treasury-Bill, a common proxy for “cash”, currently yields 5.39% (as of 4/30/2024). After more than 15 years of investor sentiment that “cash is trash”, the increase in yields on cash has people turning their heads to take note. Some investors have even raised the question, “Should cash be used as a large piece of the long-term investment strategy in my investment portfolio?” In other words, these investors have considered liquidating their current investment portfolios and moving into cash to take advantage of the presently available 5% yield.

In light of this emerging sentiment, it is prudent to explore if holding large cash positions is a competitive long-term portfolio investment strategy. For these purposes, we will consider cash performance against inflation (as represented by US BLS CPI All Urban SA 1982-1984 index) and three other investment strategies over the long term — Domestic Large Cap Equity (S&P 500 Index), Fixed Income (Bloomberg US Govt/Credit Intermediate Index), and 60% Equity/40% Fixed Income Portfolio (S&P 500 and Bloomberg US Govt/Credit Intermediate Index) analyzing data from 12/31/1972 to 12/31/2023. Through this review, we should get a better sense of whether this trend is a legitimate option or a passing fad.

I previously explored the importance of investing to protect against inflation in a 2022 post entitled “Inflation and Our Strategies to Protect Against It”![]() . Inflation is a concern to all investors, as price increases erode consumer purchasing power and negate portfolio performance over time. The most recent update from the Bureau of Labor Statistics (BLS) shows that headline inflation increased 3.4% for the 12 months ending in April 2024

. Inflation is a concern to all investors, as price increases erode consumer purchasing power and negate portfolio performance over time. The most recent update from the Bureau of Labor Statistics (BLS) shows that headline inflation increased 3.4% for the 12 months ending in April 2024 ![]() . The Fed seeks to achieve maximum employment and keep inflation at the rate of 2.0-2.5% over the longer run. Unfortunately, inflation has continued to be consistently above their targeted range in the current economic environment. The Fed has communicated their expectation that they may reduce interest rates this year dependent on future and expected declines in inflation over time, but this has not yet occurred.

. The Fed seeks to achieve maximum employment and keep inflation at the rate of 2.0-2.5% over the longer run. Unfortunately, inflation has continued to be consistently above their targeted range in the current economic environment. The Fed has communicated their expectation that they may reduce interest rates this year dependent on future and expected declines in inflation over time, but this has not yet occurred.

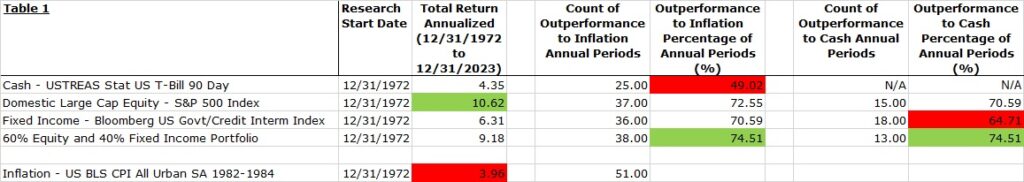

Table 1 below compares annual returns for Cash, Domestic Large Cap Equity, Fixed Income, 60% Equity/40% Fixed Income Portfolio and Inflation over the last 51 years. The table presents how often these investment options outperformed inflation, and cash, as a percentage of the available annual periods. Data was obtained from Morningstar:

The data in Table 1 shows that Domestic Large Cap Equity had the highest return at 10.62%, followed by the 60% Equity and 40% Fixed Income Portfolio with 9.18%, Fixed Income at 6.31%, and Cash at 4.35%. The good news is that returns for all allocations were above that of longer-term inflation. However, the data also shows that annual returns for Cash had the lowest historical success rate of outperforming inflation at only 49.02% of the time. The 60% Equity and 40% Fixed Income Portfolio had the highest observed success rate, outperforming inflation 74.51% of the time. The data also shows that all three non-cash investment strategies were highly likely to outperform when compared to cash. In fact, Cash outperformed the other asset classes only during periods of market decline (with a few exceptions). However, it is very difficult for investors to predict and time these downturns consistently and successfully, so finding the right time for cash over the other asset classes is almost impossible without the benefit of hindsight.

The combined findings show that cash had the lowest chance of outperforming when compared against inflation and performed the weakest when compared to the three other investment strategies. Put another way, the data shows that the 60% Equity and 40% Fixed Income Portfolio had the highest probability of outperformance when compared against both inflation and cash over the long-term. This investment approach also had the second highest return.

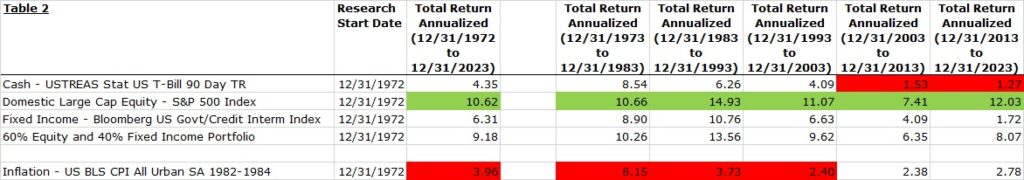

Digging a little deeper, I also reviewed cash performance against the other investment options through five consecutive 10-year time periods, or 50 years. Table 2 presents the returns for Cash, Domestic Large Cap Equity, Fixed Income, 60% Equity/40% Fixed Income Portfolio, and Inflation over five 10-year time periods:

The data presents a similar picture to our findings above — Cash underperformed the other three investment strategies in all 10-year time periods, and underperformed inflation over the last twenty years. Domestic Large Cap Equity outperformed the other investment options in all the 10-year time periods reviewed. Domestic Large Cap Equity and the 60% Equity and 40% Fixed Income Portfolio outperformed inflation in all the 10-year time periods. Fixed Income outperformed inflation in four of the five 10-year time periods.

While cash clearly serves an important purpose in any investor’s total wealth strategy (emergency savings, liquidity, and planned future purchases), moving long-term investments to cash to take advantage of short-term increased yields as a long-term investment strategy is clearly not the best strategy. Looking at the data presented above, cash was less likely to outperform inflation and consistently underperformed Domestic Large Cap Equity, Fixed Income, and a 60% Equity/40% Fixed Income Portfolio in almost all instances. Cash also provides the greatest example of reinvestment risk when compared against other investments (Investopedia ![]() – or the risk that an “investor will be unable to reinvest cash flows from an investment at a rate compared to current yields over time”). This means that the current yields available on cash are not guaranteed to stay high and could quickly decrease when the Fed expectedly reduces (or cuts) the Federal Funds rate in the future. This highlights the increased reinvestment risk of cash.

– or the risk that an “investor will be unable to reinvest cash flows from an investment at a rate compared to current yields over time”). This means that the current yields available on cash are not guaranteed to stay high and could quickly decrease when the Fed expectedly reduces (or cuts) the Federal Funds rate in the future. This highlights the increased reinvestment risk of cash.

The findings demonstrate that holding large cash positions in a long-term portfolio is not a competitive investment strategy. This strategy appears to be a “head-fake” given its relative underperformance when compared against inflation and the other investment strategies reviewed. In short, if investors are seeking long-term investments with market-like returns, they need to participate in investments with market-like risk. Cash may not be “trash”, but taken as a stand-alone investment strategy, you are likely to let a lot of potential return go to waste.

Washington Trust Bank believes that the information used in this study was obtained from reliable sources, but we do not guarantee its accuracy. Neither the information nor any opinion expressed constitutes a solicitation for business or a recommendation of the purchase or sale of securities or commodities.

Nick is a Vice President and Portfolio Manager for Washington Trust Bank's Wealth Management & Advisory Services. With nearly 20 years experience in portfolio management, he strives to bring a holistic approach to meeting our clients' goals as it relates to their investment portfolios. Nick partners with Relationship Managers to bring disciplined, comprehensive, client-focused solutions as he works with the Portfolio Management team to structure client portfolios.