Inflation! The word weighs heavily on investors and consumers alike as it erodes purchasing power and portfolio performance over time.

Focus on inflation increased in the the month of June after the US Bureau of Labor Statistics reported that the Consumer Price Index for All Urban Consumers (CPI-U) increased 8.6% ![]() , before seasonal adjustment, over the last 12 months. In their release it was noted that “the increase was broad-based, with the indexes for shelter, gasoline, and food being the largest contributors.” A longer-term review of inflation, as measured by the US BLS CPI All Urban SA 1982-1984 index, shows us that inflation averaged 3.96% from 12/31/1971 to 5/31/2022.

, before seasonal adjustment, over the last 12 months. In their release it was noted that “the increase was broad-based, with the indexes for shelter, gasoline, and food being the largest contributors.” A longer-term review of inflation, as measured by the US BLS CPI All Urban SA 1982-1984 index, shows us that inflation averaged 3.96% from 12/31/1971 to 5/31/2022.

The higher-than-expected increase in inflation also garnered the attention of the Federal Reserve in their June 15 Federal Open Market Committee statement ![]() . The Federal Reserve seeks to achieve maximum employment and keep inflation at the rate of 2 percent over the longer run. As recently as November, it was their view that the elevated inflation was expected to be transitory. However, inflation’s persistence since has caused the Fed to change their opinion and led them to raise the Federal Funds rate over time to combat inflation. In their press release, the Federal Reserve stated that “Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher energy prices, and broader price pressures.” In addition, “The invasion of Ukraine by Russia is causing tremendous human and economic hardship. The invasion and related events are creating additional upward pressure on inflation and are weighing on global economic activity. In addition, COVID-related lockdowns in China are likely to exacerbate supply chain disruptions.” The Federal Reserve is “highly attentive to inflation risks” at this time and also stated they are “strongly committed to returning inflation to its 2 percent objective.”

. The Federal Reserve seeks to achieve maximum employment and keep inflation at the rate of 2 percent over the longer run. As recently as November, it was their view that the elevated inflation was expected to be transitory. However, inflation’s persistence since has caused the Fed to change their opinion and led them to raise the Federal Funds rate over time to combat inflation. In their press release, the Federal Reserve stated that “Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher energy prices, and broader price pressures.” In addition, “The invasion of Ukraine by Russia is causing tremendous human and economic hardship. The invasion and related events are creating additional upward pressure on inflation and are weighing on global economic activity. In addition, COVID-related lockdowns in China are likely to exacerbate supply chain disruptions.” The Federal Reserve is “highly attentive to inflation risks” at this time and also stated they are “strongly committed to returning inflation to its 2 percent objective.”

It should be noted that although current inflation is high even by historical standards, the issues and trends underlying it are affecting not just the United States, but also numerous developed economies around the globe, as shown in data presented by Trading Economics ![]() .

.

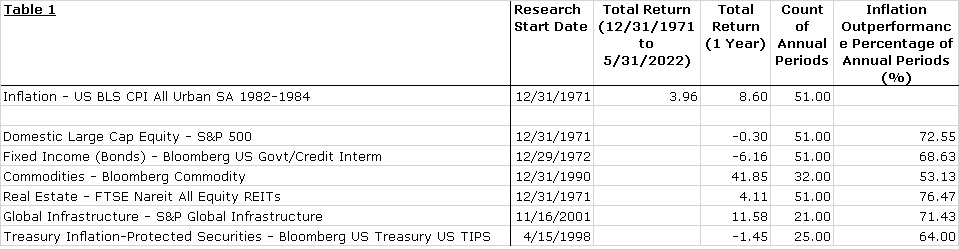

Unsurprisingly, investors have taken note of the elevated inflation and rising interest rates and there has been an increase in market volatility for most of 2022. At Washington Trust Bank Wealth Management & Advisory Services, we invest in a number of asset classes to help provide protection against inflation as part of a diversified portfolio strategy. These asset classes include real estate, commodities, global infrastructure, and Treasury Inflation-Protected Securities, or TIPS. As presented earlier, inflation averaged 3.96% over (approximately) the last 51 years. I reviewed annual returns of several asset classes and compared these returns to the annual change in inflation. I then determined how frequently, as a percentage of available annual periods, these asset classes outperformed inflation. The asset classes reviewed were domestic large cap equity, fixed income (bonds), commodities, real estate, global infrastructure, and TIPS.

Looking at the data presented, we find that the asset class returns exceeded inflation over the period of time available at the following percentages – commodities 53.1%, real estate 76.5%, global infrastructure 71.4%, and TIPS 64.0%. The data updates research by Case, Wachter, and Worley (2011) ![]() , which found that REITs protected against inflation 65.8% of the time, commodities 70.4% of the time; and that both asset classes provided better protection than stocks (60.8% of the time). That research also showed that TIPS outperformed inflation 53.8% of the time. Looking at 1 year returns, I would also note that two asset classes are showing strong returns over this period of time: commodities +41.9% and global infrastructure +11.6%. The data demonstrates that commodities, real estate, global infrastructure, and TIPS have historically, and should be expected, to provide an effective hedge against inflation in the portfolio.

, which found that REITs protected against inflation 65.8% of the time, commodities 70.4% of the time; and that both asset classes provided better protection than stocks (60.8% of the time). That research also showed that TIPS outperformed inflation 53.8% of the time. Looking at 1 year returns, I would also note that two asset classes are showing strong returns over this period of time: commodities +41.9% and global infrastructure +11.6%. The data demonstrates that commodities, real estate, global infrastructure, and TIPS have historically, and should be expected, to provide an effective hedge against inflation in the portfolio.

A quick comment, if you cannot access or purchase TIPS through an investment portfolio, you can also purchase Series I Savings Bonds from the US Treasury via TreasuryDirect ![]() , although you can only purchase up to $10,000 each calendar year.

, although you can only purchase up to $10,000 each calendar year.

In this challenging environment, it is important for investors to have portfolio holdings that help improve diversification and protect portfolio value and purchasing power against the negative impacts of inflation.

Washington Trust Bank believes that the information used in this study was obtained from reliable sources, but we do not guarantee its accuracy. Neither the information nor any opinion expressed constitutes a solicitation for business or a recommendation of the purchase or sale of securities or commodities.

Nick is a Vice President and Portfolio Manager for Washington Trust Bank’s Wealth Management & Advisory Services. He offers our clients the expertise to analyze portfolios and unique assets to ensure that they are suitable for meeting our clients’ goals and needs. Nick partners with our Relationship Managers to provide continual analysis to ensure that these customized portfolio solutions maintain the balance between risk and growth in order to ensure continued success in meeting the clients’ goals.