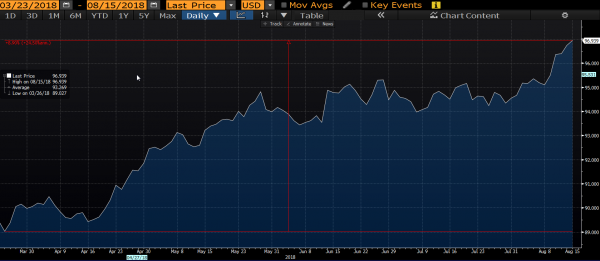

Lost among all of the stories of tariffs and trade wars is the fact that, since the trade issues began heating up in March, the dollar has appreciated almost 9% versus a basket of the major developed country currencies and 10% against the Chinese currency. The chart below highlights this trend.

This means that US exporters are facing a “market tariff” of almost 10% on all of their exports to all of their export countries that have seen dollar appreciation. The 25% tariffs are only on selected items of the countries imposing the tariff. What this means for businesses who export goods is that a stronger dollar makes their goods more expensive for the foreign country, company or individual desiring to buy them. Thus, it acts like a tariff. US exporters would have to lower the price of their goods in order to maintain sales, or see their sales decrease as the foreign buyer seeks other sources to buy the goods.

Unfortunately, this is creating an additional headwind for US exporters. For those exporters who are already facing the new tariffs, this is an additional challenge to deal with. If US exporters have to lower their sales price to maintain sales, then they will have to look for ways to reduce expenses if they wish to maintain their current profit margin. Since labor costs are a major component of most businesses’ expenses, this risks them responding through slower jobs growth, slower wage growth, reduced benefits, automation, or job losses.

The other half of the dollar story is that a strengthening dollar makes imported goods cheaper for US companies that import some or all of their raw material and for consumers who buy imported products. This may provide some relief for businesses hit with higher costs on imported goods due to the new tariffs and dampen price increases that consumers may see for imported products.

This highlights the interconnected global economy with multiple moving parts. It also highlights how a simple solution does not exist for efforts to reduce trade deficits. Here is the trade deficit challenge when you add in the dollar:

The fact is that the US currently has the strongest economic growth among developed countries and the highest interest rates. Both of these macro factors make the US an attractive investment for many foreign investors and increases demand for the dollar. Add in the geopolitical turmoil that currently exists and you increase demand for holding dollars as a safe haven. These factors indicate that the dollar could remain at the current level or strengthen as long as these factors are in place. The ultimate impact to the economy remains to be seen.

What we may discover is that, while tariffs and trade wars garner a large amount of media coverage, the real story for US consumers and businesses may be the dollar’s trend for the rest of the year.

Steve Scranton is the Chief Investment Officer and Economist for Washington Trust Bank and is a CFA charter holder with over 30 years of investment experience with equities, tax-exempt and taxable fixed income securities. Steve actively participates on committees within the bank to help design strategies and policies related to client and bank owned investments. Steve also serves as the economist for the Bank and has been a featured speaker for both client and professional organization events throughout the Northwest.