The Federal Open Market Committee (FOMC) is the monetary policymaking body of the Federal Reserve System. The FOMC is composed of 12 members – the seven-member Board of Governors and five members drawn from the 12 regional Reserve Bank presidents. The Chairman of the Federal Reserve, currently Jerome Powell, also serves as the Chair of the FOMC; the six remaining Board members, along with the president of the Federal Reserve Bank of New York, are permanent voting members. The other four voting positions are typically filled each year on a rotating basis from the remaining presidents of the other regional Reserve Banks.

The year 2022, however, is shaping up to be anything other than a typical year. Not only will the usual shuffling of voting responsibilities among the 12 regional Federal Reserve Bank Presidents occur, but there is opportunity for President Biden to reshape the Federal Reserve’s Board of Governors as well.

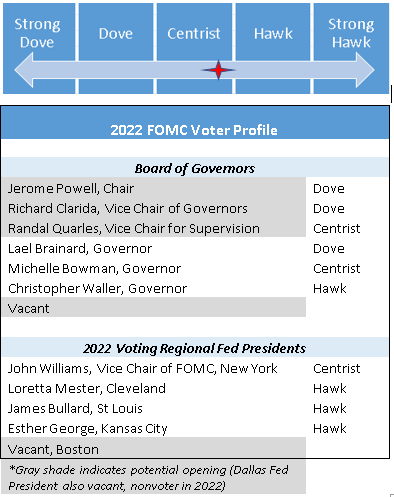

The current board of Fed governors has six members and one vacant position. Chairman Jerome Powell was nominated to the board by former President Barack Obama and then appointed to the Chairman role by former President Donald Trump in 2018. Powell’s term as Chair of the FOMC expires in February, while his term on the Board of Governors doesn’t expire until 2028. Board Vice Chair Richard Clarida’s term ends in January 2022. Additionally, Board of Governors member Randal Quarles, who served as Vice Chair of Supervision, saw his term in that role end in September 2021.

President Biden now has the opportunity to renominate or replace each of these members in their respective roles. There is potential for him to shepherd in an era where the central bank has more women and people of color along with those who may put more monetary-policy emphasis on reducing economic inequality.

Along with filling the positions of chair, vice chair, vice chair of supervision and the vacant board seat, the Fed will also welcome two new regional Fed Presidents at some point in the near future. Dallas Fed President Robert Kaplan and Boston Fed President Eric Rosengren both retired this month after their personal investment trading activity during the pandemic came under scrutiny. Whoever is chosen to replace Rosengren will have a voting seat on the FOMC in 2022.

The Fed and the FOMC continue to face the ongoing challenge of repairing the US economy from the damage caused by the coronavirus pandemic. The FOMC will determine when to finally conclude actively expanding the central bank’s balance sheet along with when to raise rates from record-low levels. There is wide speculation on whom President Biden may nominate to fill out the board, with many expecting him to renominate Chair Powell but to appoint current board member Lael Brainard to the post of Vice Chair of Supervision – the central bank’s top banking regulator.

At the FOMC’s most recent meeting in September, nine of the 18 voters thought that it would be appropriate to begin raising rates by the end of 2022. With the potential for six new faces on the committee, five of them being voting members in 2022, the implications for future monetary policy are enormous. Expect to hear more from us as nominations and deliberations get underway.

Callen is a Portfolio Manager for Washington Trust Bank’s Wealth Management & Advisory Services. He is responsible for selecting and managing tax-exempt securities for Wealth Management & Advisory Services client portfolios. Callen is part of the fixed income team within the Wealth Management & Advisory Services investment team and actively works to construct tax exempt fixed income portfolios for tax sensitive clients. With his education and over 10 years of financial markets experience, Callen is able to bring valuable expertise to the fixed income portfolio management process that is designed to meet client goals.