The last month of December 2018 foretold the precipitous drop that was about to happen to interest rates in 2019, even if Federal Reserve officials thought otherwise.

In December 2018, the Fed raised interest rates for the last time in this cycle. Immediately the market took this as a mistake or the straw that would break the tentative strength of the economy’s back.

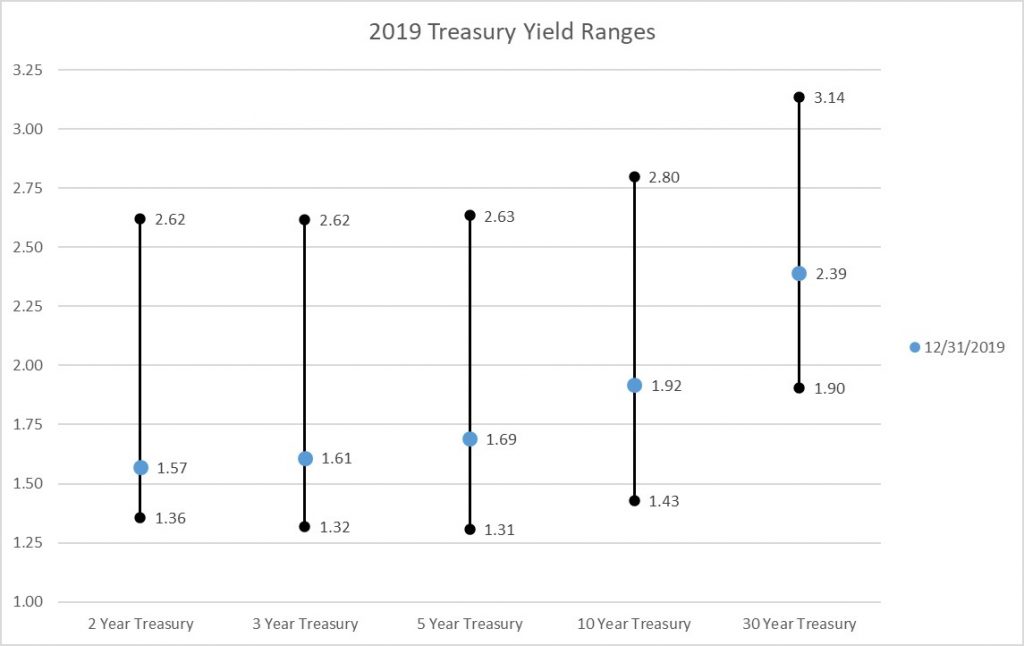

As the global economy weakened, especially Europe and China, and the US economy showed signs that it was not immune to these forces (as evidenced by the inverting yield curve), the Fed made a major change in the 1st quarter by moving to a neutral monetary policy stance and announcing an end to its quantitative tightening by September 2019. The policy change was a major move, and Fixed Income markets reacted accordingly by driving interest rates lower. Expectation that the US economy would slow had become a prevalent theme among fixed income investors.

Trump, tweets, and tariffs grabbed the headlines and investors’ attention, but slowing global economic growth, along with decreasing inflation expectations, were the main impetuses to the world’s major central banks’ interest rate policies in the 2nd quarter.

Interest rates took a dramatic turn lower as investors priced in multiple rate cuts. Almost daily, investors faced tweets from President Trump regarding the ongoing trade dispute with China. For the first five months, investors were optimistic a trade deal was imminent. But talks broke down in May and investors were faced with the prospect that the trade dispute with China could go on for a very long time. The basic view from investors was that a trade war between the two largest economies would decrease economic growth, not only to the two main parties but also to the many other countries that are part of the global economic supply chain.

Investors’ fears started to come true as economic data from China and the US disappointed. This just added on to an already weak Europe which had Italy in a recession and Germany very close.

The negativity was not lost on the Federal Reserve or the European Central Bank. At the June meeting for both banks, their respective leaders gave clear indications to prepare investors for a rate cut. ECB President Mario Draghi said there is room to cut interest rates from the current record lows. Fed Chair Jerome Powell said the FOMC committee sees the case for “somewhat more accommodative policy” citing trade developments and concerns about global growth. As a result, interest rates declined an additional 50 basis points in the 2nd quarter.

The 3rd quarter was a very volatile quarter for interest rates as investors were torn between ongoing weakness in the global economy, the up and down trade dispute between the US and China, the resilience (to date) of the US consumer, and changing Federal Reserve policy.

Acknowledging the global economic weakness and its potential effects on the US, the Fed began to telegraph its intentions to change the course for monetary policy early in the quarter, fulfilling the foreshadowing on July 31st. At that time, the Fed cut interest rates 25 basis points and ended its balance sheet runoff program early. The reason for the cut was “the implications of global developments for the economic outlook.” This was interpreted as the implications caused by trade policy.

Taking the cue that the rate cut was because of trade policy, President Trump, who wanted the Fed to cut rates faster and further, tweeted that he was going to impose an additional 10% tariff on the remaining $300 billion worth of Chinese imports. With China responding by weakening its currency and stopping agricultural purchases, concerns of a full-fledged trade war between the two largest economies ignited fears of a slowing global economy and potential recession.

Investors’ reaction was swift as they tried to lock in yields for as long as possible. The US 30-year at one point reached an all-time low of 1.91% and the amount of negative yielding global debt broached $17 trillion.

Meanwhile, US policymakers continued to face a conundrum as domestic economic growth, led by the consumer, remained positive even with the manufacturing side clearly affected by trade.

The Fed cut rates 25 basis points once again in September for the same reasons as in July, but Fed officials were clearly divided by the weakening global economic environment and a resilient US consumer.

The 4th quarter started out all doom and gloom but an optimistic ray of light soon took hold to move interest rates higher from their lows.

Impetus for the doom and gloom centered on the ongoing trade dispute between the US and China and its negative effects on the global economy. The weakness was clearly evident in the manufacturing sector with Europe leading the way. But the manufacturing sector in the US was also under pressure. The big fear was that this weakness would start to negatively affect the US consumer, which up to this point had escaped the brunt of the damage.

A hard Brexit was another source of concern as investors feared the ramifications of the UK leaving the European Union without a trade deal.

But the 4th quarter saw changes on both fronts. Tensions between the US and China began to ease as the likelihood of a phase one trade deal took hold. And finally, clear direction came to Brexit with the resounding victory by Boris Johnson. It is basically certain that the UK will leave the EU with at least some form of negotiated deal instead of the feared “hard Brexit” which would have seen the UK leave the EU without any deal. Global de-escalation in the form of movement on Brexit and US/China trade seemed to be the motivation for investors that had grown accustomed to negative news.

With the escalation of negativity easing, economic data also began to follow suit. Caterpillar’s CFO Andrew Bonfield stated it succinctly, “Our customers are not facing financial difficulties. It’s more that they seem to be waiting to see what happens with the economic outlook before making decisions.”

Taking the cue, the US Federal Reserve and the EU seemed to move monetary policy to the pause switch. After cutting the Fed Funds rate in late October, Chairman Jay Powell indicated that it would take a “material reassessment” of the committee’s economic outlook to alter its bias towards a pause, but also added that it would take a “serious” increase in inflation to consider an increase in rates.

The views or opinions in this article are those of the author and do not necessarily represent the views of Washington Trust Bank or senior management. Washington Trust Bank believes that the information used in this blog was obtained from reliable sources, but we do not guarantee its accuracy. Neither the information nor any opinions expressed constitutes a solicitation for business or a recommendation of the purchase or sale of securities or commodities.

Brian is a Vice President and Senior Portfolio Manager who manages the fixed-income investment process for Wealth Management & Advisory Services clients by providing sophisticated investment counsel and portfolio risk control strategies. Brian is the bank’s primary fixed-income strategist and oversees the strategy, implementation and trading of all fixed-income securities for both private and institutional capital. Brian also holds a Chartered Financial Analyst designation. He has more than 20 years of portfolio management and institutional investment experience. Brian's significant expertise in fixed income is a key to our clients’ financial success, as he positions them to both safe and well positioned portfolios.