Over the last twelve months, oil prices have moved up smartly to where oil is now hovering around $70 per barrel. That’s a 40% rise since this time last year and 150% jump from the lows hit in January 2016. So, what’s behind the dramatic increase?

Source: Bloomberg

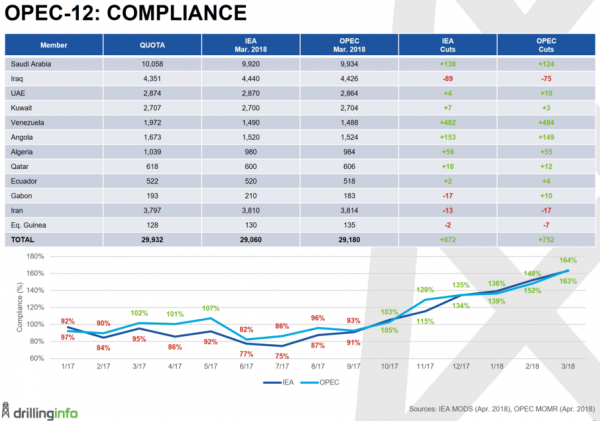

As we mentioned before in 2016, OPEC (led by Saudi Arabia) and Russia agreed to production cuts. To date, members have largely remained near the limits to which they agreed. Prior to 2016, the Saudis led production increases to crush prices in order to punish the Russians and Iranians, with whom they were in military conflict, and to squeeze out American producers who were taking market share. However, by 2016 the lower prices became too much of a strain on the budget, so they worked with Russia to curb production and stabilize prices. As a result, prices rose to the $50/barrel range. OPEC has extended those cuts and now the Saudis would like to see prices move even higher. Later in the year or early 2019, they plan to have Aramco, their state owned oil and gas company, go public. A higher oil price will boost the IPO price and earn the state more money. They are targeting oil prices of $75 to $85/barrel. So, their near term goals have shifted considerably over the last few years.

As expected, the rise in prices has led to a rise in US production, and at these prices much of the US production becomes profitable. Ramping up production quickly is not an issue. Currently, the US has over 1,600 wells drilled but uncompleted. This high inventory means domestic supply could increase quickly without significant changes in the number of active drilling rigs. But the number of drilling rigs has jumped substantially from the lows. In May of 2016, the US rig count had fallen to 433 active rigs. Today, that number has ballooned to 1,141. The problem is not production, but takeaway capacity – the ability to bring production to market. Pipeline problems could mean that the supply of oil remains below demand for the rest of the year.

Synchronized global growth has increased the demand for oil, but global supply has only grown by less than ½% in each of the preceding two years. Estimates have current world supply below demand by about 700,000 barrels per day. As a result, inventories are being drawn down around the globe to levels close to the five year average.

While most OPEC nations are adhering to production quotas, the nation having the biggest effect on the reduction in global supply is Venezuela, and it is not due to production quotas. In fact, they are producing well below their quota. The reason: politics. Last fall, Venezuela’s government launched a purge. As a result, most foreign producers have left the country. Recently, two Chevron workers were imprisoned over a dispute with Venezuela’s state owned oil company PDVSA. The Chevron employees refused to sign a new supply contract drawn up by PDVSA executives and now face charges of treason.

While Venezuela boasts the world’s largest proven oil reserves, production continues to decline. Venezuela is now producing about 1.49 million barrels per day, 482,000 barrels below their quota. Output could decline to 1.38 million barrels per day by year end. Given the current state of affairs in Venezuela, any turn around in production is unlikely.

Given the environment, even with US production on the rise, oil prices could remain at or above the $70 level this year. At these prices, corporate earnings growth in the US should be lifted. Outside of the US, global growth has remained healthy as well. In fact, the IMF just raised its growth forecast. Needless to say, at some point rising prices will cut into consumers’ wallets and curtail growth. Hopefully, the gap between supply and demand will be small enough and keep prices well below their historic highs.

Washington Trust Bank believes that the information used in this study was obtained from reliable sources, but we do not guarantee its accuracy. Neither the information nor any opinion expressed constitutes a solicitation for business or a recommendation of the purchase or sale of securities or commodities.

Washington Trust Bank.