2022 has been a challenging year for the markets and especially for residential real estate. Individuals looking to purchase a home have been negatively impacted by rising mortgage rates, which have significantly increased the cost of their expected monthly mortgage payment.

Indeed, mortgage rates have risen significantly, adding to the cost of a mortgage. According to Bankrate.com, the 30-year national mortgage rate ![]() has increased 344 basis points to 6.67% as of 11/30/2022 (from 3.23% a year ago). While elevated, this recent 30-year mortgage rate is a slight improvement from the 12-month high of 7.35% observed on 11/3/2022. During this same period, the median home price increased 3.49% to $370,700 (from $355,700 a year ago) according to the National Association of Realtors (NAR) report on existing home sales

has increased 344 basis points to 6.67% as of 11/30/2022 (from 3.23% a year ago). While elevated, this recent 30-year mortgage rate is a slight improvement from the 12-month high of 7.35% observed on 11/3/2022. During this same period, the median home price increased 3.49% to $370,700 (from $355,700 a year ago) according to the National Association of Realtors (NAR) report on existing home sales ![]() . NAR noted “This marks 129 consecutive months of year-over-year increases, the longest-running streak on record.” The increases in interest rates and median home prices have caused potential buyers’ monthly mortgage payment (the sum of the principal and interest) to spike a whopping 53.36% to $1,907.74 (from $1,243.98 a year ago). The table below illustrates the change in monthly payment, assuming a 20% down payment.

. NAR noted “This marks 129 consecutive months of year-over-year increases, the longest-running streak on record.” The increases in interest rates and median home prices have caused potential buyers’ monthly mortgage payment (the sum of the principal and interest) to spike a whopping 53.36% to $1,907.74 (from $1,243.98 a year ago). The table below illustrates the change in monthly payment, assuming a 20% down payment.

| As of | 11/30/2021 | 11/30/2022 | Change | |

| Median Home Price per NAR Existing Home Sales | $ 358,200.00 | $ 370,700.00 | 3.49% | |

| Down Payment (20%) | $ 71,640.00 | $ 74,140.00 | ||

| Mortgage Length (30 Years) | 360 | 360 | ||

| 30 Year Mortgage Rate per Bankrate.com National Average | 3.23% | 6.67% | 3.44% | |

| Monthly Payment (Principal and Interest) | ($1,243.98) | ($1,907.74) | 53.36% |

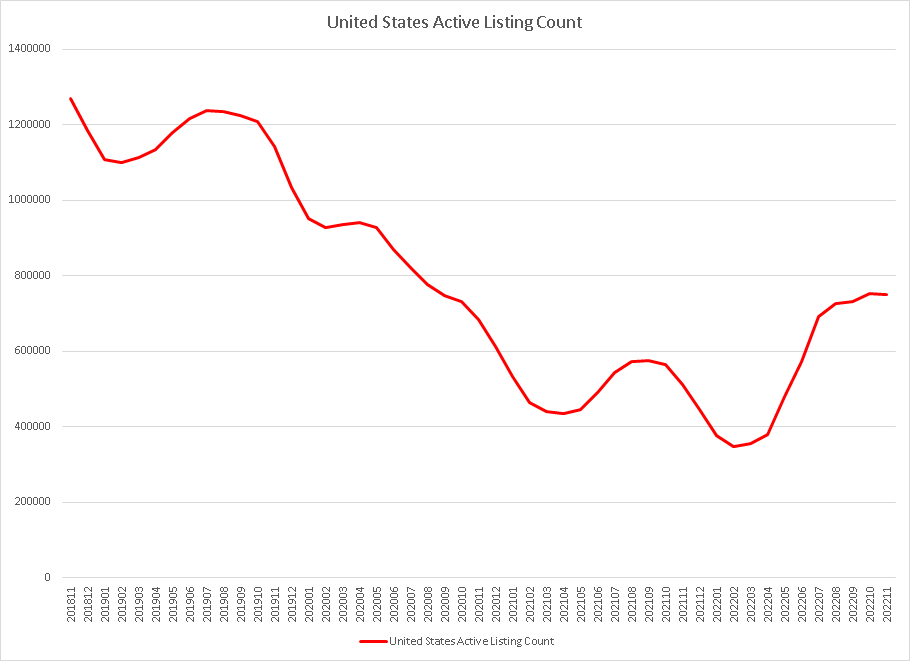

Despite this dramatic increase in monthly payments on the purchase of residential real estate, home prices have continued to rise so far this year. One of the reasons for the resilience in home prices observed is that the available housing inventory market remains “tight” (meaning supply is limited). Realtor.com publishes data for active residential real estate listings. ![]() . Looking closer at this data, the number of active listings has increased somewhat over the course of 2022 to approximately 752,000 units (as of 11/30/2022). However, this recent observation remains quite low when compared to the previous 5-year average for this time of year of 872,000 units. This number is also half the highest number of active listings during this period of time of 1,271,000 units (observed 11/30/2018).

. Looking closer at this data, the number of active listings has increased somewhat over the course of 2022 to approximately 752,000 units (as of 11/30/2022). However, this recent observation remains quite low when compared to the previous 5-year average for this time of year of 872,000 units. This number is also half the highest number of active listings during this period of time of 1,271,000 units (observed 11/30/2018).

In their release, NAR Chief Economist Lawrence Yun stated that “In essence, the residential real estate market was frozen in November, resembling the sales activity seen during the COVID-19 economic lockdowns in 2020 … The principal factor was the rapid increase in mortgage rates, which hurt housing affordability and reduced incentives for homeowners to list their homes. Plus, available housing inventory remains near historic lows.”

The data clearly shows the residential housing market is tight. This statement is also affirmed by the existing home sales report, which states there is currently a 3.3 month supply available in the market. In the residential housing market, it is said that it is a sellers’ market when there is less than a 6 month supply available, and a buyers’ market when there is greater than a 6 month supply. According to the data, it appears that we continue to be in a sellers’ market. This sellers’ market is occurring even with the significant increase in monthly mortgage payments that are being negatively impacted by rising mortgage rates.

It remains to be seen if the continued increase in residential home prices can occur going forward. I believe that prices will need to decline to ease buyers’ pain given the year’s significant increase in mortgage rates. This expected decrease in prices should make the residential housing market more accessible and allow individuals to purchase a home more affordably.

Washington Trust Bank believes that the information used in this study was obtained from reliable sources, but we do not guarantee its accuracy. Neither the information nor any opinion expressed constitutes a solicitation for business or a recommendation of the purchase or sale of securities or commodities.

Nick is a Vice President and Portfolio Manager for Washington Trust Bank’s Wealth Management & Advisory Services. He offers our clients the expertise to analyze portfolios and unique assets to ensure that they are suitable for meeting our clients’ goals and needs. Nick partners with our Relationship Managers to provide continual analysis to ensure that these customized portfolio solutions maintain the balance between risk and growth in order to ensure continued success in meeting the clients’ goals.