Just as the dust was beginning to settle from the pandemic, here we are worrying about something new — the Russian invasion of Ukraine. Arguably, the world has been a scary place for a while and the invasion has made it a bit worse. The war has brought about new levels of uncertainty, market volatility and my favorite four-letter f-word…fear. Fear is a natural, powerful, and primitive human emotion that, more often than not, leads to bad decisions, making it difficult for many to “stay the course”. During these periods of intense uncertainty, emotions frequently run hot, which tempts clients look for the exits. As disciplined and patient professionals, it is our responsibility to help our clients manage their emotions and help them find their Zen by shifting the focus away from the turbulence of today back to their plan, their goals and the long term. Accordingly, I’ve pulled together a few examples to help with this conversation.

War is a tragic consequence of the human condition and provides us with very real reasons to be concerned. Lives are lost, families are separated, cities are destroyed, and economies are impacted. While our attention is currently focused on disruptions brought about by the conflict in Ukraine, should our clients be equally concerned about their portfolios? Using history as an indicator, I would argue that they should not.

Fortune magazine recently took a look at five major conflicts and how they impacted stocks. The bottom line is that the markets often do respond negatively to military conflicts but also tend to bounce back relatively quickly.

Even though the markets tend to recover relatively quickly, fear often takes over and clouds the decision-making process, frequently leading to tactical management, or attempting to time the markets. When emotions run hot, people easily find a reason to sell — and often at the wrong time. What follows is a short list of relatively recent events that investors have pointed to as reasons to sell to cash:

What’s worse is that even as the markets recover, for those who let their emotions get the best of them, it’s often very difficult to find a reason to buy. Compounding that observation is the acknowledgement that often when things are at their scariest is when it is the best time to buy. But that’s extremely hard to do when things look very bad. With this in mind, one of my opinions that I’m somewhat fond of sharing with clients is, “when attempting to time the markets, you need to be right at least twice: once on the way out and again on the way back in”. Given that hindsight is the only thing that is truly 20/20, we do not believe that market timing is a winning strategy for meeting financial goals.

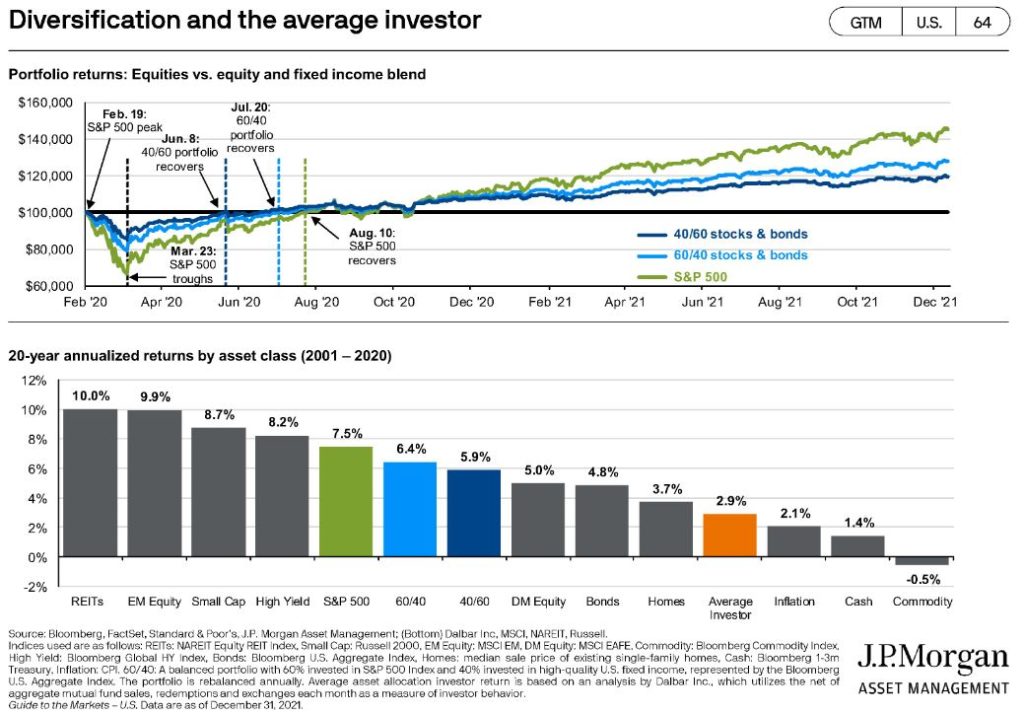

In an effort to drive this point home further, I feel it’s worth pointing to a JPMorgan study. Every quarter this study monitors the results of behavioral finance by comparing the annualized returns over 20-year periods of various minor asset classes, diversified portfolios, and the S&P 500 versus the average investor. For the most recent quarter, the results speak for themselves:

This is not a one-time fluke. Their study consistently shows that the average investor does far worse than a diversified portfolio and a disciplined process, primarily because of the emotional factor that drives decision making for many individual investors.

*Average asset allocation investor return is based on analysis by Dalbar Inc., which utilizes the net of aggregate mutual fund sales, redemptions and exchanges each month as a measure of investor behavior.

Arguably, the markets have an upward bias. If they didn’t, we likely wouldn’t have any interest in investing. Another way I tend to think about the markets is akin to flipping a weighted coin. Most of the time it comes up heads, but every once in a while, it comes up tails. Because of this, we believe the best way to invest successfully is to diversify, allocate appropriately and most importantly not make changes unless your fundamental goals and/or financial plan have changed.

Washington Trust Bank believes that the information used in this study was obtained from reliable sources, but we do not guarantee its accuracy. Neither the information nor any opinion expressed constitutes a solicitation for business or a recommendation of the purchase or sale of securities or commodities.

Matthew Clarke, CIMA® is a Vice President and Senior Client Portfolio Manager for Washington Trust Bank’s Wealth Management & Advisory Services. Within the Portfolio Management Group, he works with a team of portfolio experts who analyze and coordinate strategies on behalf of our clients who require both a high level of customization and expert communication. Working with our Relationship Managers, Matthew represents a client-focused, comprehensive and disciplined approach to investment management that emphasizes our consideration to the client’s “big picture.” His active participation in our client relationships is instrumental for our continuous success in meeting their goals. Matthew has over 10 years of financial industry experience and is often called upon for investment strategies that support the sale of business, concentrated stock holdings and other financial events that require significant consideration and analysis.