As I mentioned in my previous blog (click here to read) alternatives are an important tool in managing portfolio risk. Since volatility is the biggest drag on performance, managing this risk and limiting portfolio drawdowns is essential in preserving and growing wealth. Historically, portfolio diversification was achieved by allocating among stocks, bonds, and cash, However, during any given year, a 10% pullback in stocks occurs more than half the time. Per Goldman Sachs, when markets are elevated that percentage increases to 63%.

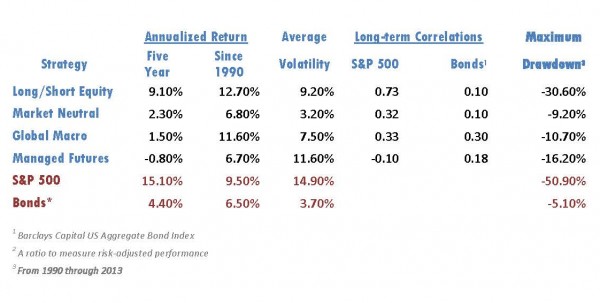

Since the performance of many alternatives is not tied to the performance of stocks or bonds, they can reduce volatility without lowering returns. To be sure, all alternatives are not alike, and some are more correlated or reliant on the movement of stocks and bonds than others. The table[1] below illustrates the differences in some of the more commonly used risk reduction alternative strategies. It should be clear that while alternatives are different from the usual equity and fixed income asset classes, they are not homogeneous and have very diverse characteristics. In addition, although we generally refer to them as alternative assets, it is more accurate to call them alternative strategies because many of the strategies use stocks or bonds, they just manage them differently.

Long/short equity strategies invest in the stock market and generally move in the same positive or negative direction as the equity market, but with less volatility.

Market neutral strategies involve going both long and short stocks in equal amounts so your return is principally due to the manager’s ability to buy stocks that will increase in value and short stocks that will lose value, not by the movement in the market.

Global macro strategies focus on global economies and profit by investing in assets whose prices are most directly influenced by macro events. Consequently, they participate in all major markets: bonds, currencies, commodities, and equities.

Managed futures describes the category of alternative strategies that specialize in using the global futures markets. In place of stocks and bonds, managers invest in futures contracts and most try to capitalize on trends.

While the table above highlights common hedge funds used to reduce risk, alternatives also include investments to hedge against inflation. These strategies, called real return strategies, have a higher correlation to the movements in the price index (inflation) than common stocks, providing inflation protection. These strategies include: commodities, real estate, and infrastructure investing. Commodities and commercial real estate tend to rise with the level of inflation and, as a result, offer inflation protection despite the added volatility.

Infrastructure investing is basically investing in the base upon which economic growth is built. This base includes a country or community’s roads, utilities, water, sewage, etc. Infrastructure investments share attributes of private equity, real estate, and fixed income.

While alternatives can improve risk adjusted returns, historically their availability has been limited. With the advent of more liquid investments, like mutual funds and exchange-traded funds (ETFs), alternative investments can add value to a much larger group of investors. Similar to the way stock and bond mutual funds expanded the ability of smaller investors to invest in the markets, so too can alternative mutual funds. There is a caveat: while adding alternatives can lower risk, because of their complexity and differences, proper due diligence is needed before investing.

[1] Source: Hedge Fund Research as of Dec 31, 2013

Washington Trust Bank believes that the information used in this study was obtained from reliable sources, but we do not guarantee its accuracy. Neither the information nor any opinion expressed constitutes a solicitation for business or a recommendation of the purchase or sale of securities or commodities.

Washington Trust Bank.