Last Tuesday the S&P 500 lost over 1%, and that hasn’t happened since October – which makes the streak quite long. Volatility has been extremely low and investors have become complacent. The downdraft serves as a reminder that the markets don’t always go up and volatility remains part of the investment equation. Besides a near-term inconvenience, it must be remembered that volatility reduces long-term growth and should be reduced as much as possible.

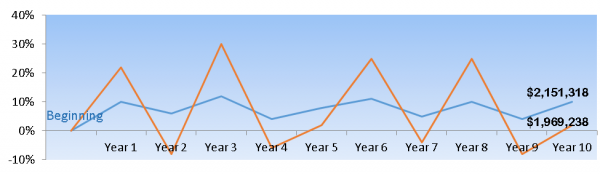

First, from a mathematical perspective, volatility is harmful to growth because it acts as an anchor on compounding returns. Look at two hypothetical $1million portfolios that have average annual returns of 8% for the ten year period. While the average returns were the same, the portfolio with lower volatility grew by nearly 10% more.

The drag on growth can be estimated with a formula, but I won’t bore you with the math here. Suffice it to say that volatility is not a friend to growing your assets.

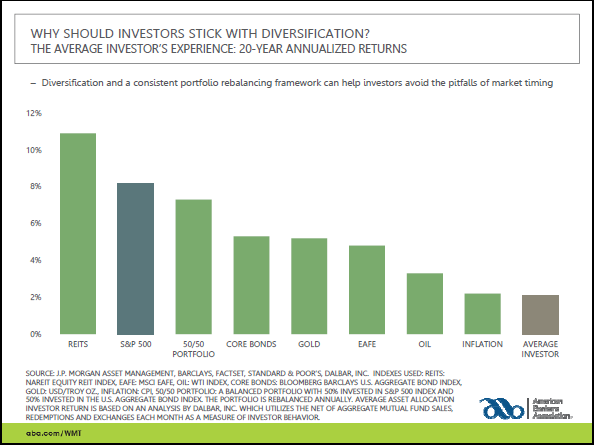

The second problem with volatility is its effect on emotions. Numerous behavioral finance studies show how emotions play havoc with investment decisions and force investors to jump in and out of the market at the wrong time. As a result, realized returns suffer. The table below quantifies this effect and illustrates how poorly the average investor does by realizing returns well below the returns of stocks and bonds.

Therefore, reducing portfolio volatility through risk management is vital to attaining one’s long-term goals.

So what does risk management entail? First of all, you need to make sure your portfolio is broadly diversified. This won’t eliminate market risk, but it will eliminate firm specific risk. Diversification goes beyond simply having a number of different stocks or asset classes in your portfolio. Many stocks and asset classes are susceptible to the same risk factors, so in order to properly diversify you need to spread your exposure to risks as well.

To reduce market risk, high quality bonds can be added to the portfolio to hedge the stock holdings. Investment grade bonds usually rise during periods of market stress. Alternative assets, that have low or negative correlation to the stock market, can also be used to hedge volatility. Finally, dynamic hedging can also be used to improve stability. Studies have shown that reducing portfolio risk when market risk is high and vice versa has improved returns while lowering volatility. To be clear, this is not to be confused with market timing. While some attempt to time the market, research has shown that the 15 most commonly used indicators on which predictions are made have little-to-no predictive power on the short-term movement of the market.

So, curbing volatility is important, whether you are aggressive or conservative. All other things being equal, the more volatility in your portfolio, the slower your growth.

Washington Trust Bank believes that the information used in this study was obtained from reliable sources, but we do not guarantee its accuracy. Neither the information nor any opinion expressed constitutes a solicitation for business or a recommendation of the purchase or sale of securities or commodities.

Washington Trust Bank.